Home Insurance Non Renewal Because of House Paint: The Lowdown

===========================================================

Table of Contents

- What’s the Big Deal About House Paint?

- How Can Your Home Insurance Non Renewal Happen Because of House Paint?

- Types of House Paint That Can Lead to Home Insurance Non Renewal

- What to Do If You Receive a Home Insurance Non Renewal Notice Because of House Paint

- The Cost of Home Insurance Non Renewal Because of House Paint

- Conclusion: Home Insurance Non Renewal Because of House Paint

What’s the Big Deal About House Paint?

Home insurance non renewal because of house paint might sound like a joke, but it’s no laughing matter. Your home’s exterior and interior paint can affect your home insurance policy in ways you never thought possible. Insurance companies take into account various factors when assessing your home’s risk, and house paint is one of them. In this article, we’ll break down how your house paint can lead to home insurance non renewal and what you can do about it.

House Paint and Risk

Your house paint may seem like a minor detail, but it can play a significant role in determining the risk your home poses to the insurance company. For instance, if your home’s paint is peeling or damaged, it can lead to water damage or other issues that may cost the insurance company money in the long run.

How Can Your Home Insurance Non Renewal Happen Because of House Paint?

Home insurance non renewal because of house paint can happen for a few reasons. Here are some possible scenarios:

1. Peeling or Damaged Paint

If your home’s exterior or interior paint is peeling or damaged, it can lead to water seepage, which can eventually cause structural damage to your home. Insurance companies may view this as a high-risk situation, which could lead to home insurance non renewal.

2. Use of High-Risk Materials

If you’ve used high-risk materials in your home, such as lead-based paint, it can increase the risk of health hazards and property damage. This can lead to home insurance non renewal because of house paint.

3. Lack of Maintenance

If you’ve neglected to maintain your home’s paint, it can lead to damage and other issues that may cost the insurance company money. In this case, home insurance non renewal because of house paint is a possibility.

Types of House Paint That Can Lead to Home Insurance Non Renewal

While not all house paint is created equal, some types of paint can increase the risk of home insurance non renewal. Here are some examples:

1. Lead-Based Paint

Lead-based paint is a no-go for home insurance companies. Lead is a toxic substance that can cause serious health problems, especially in children. If your home contains lead-based paint, it’s essential to remove it or contain it properly to avoid home insurance non renewal.

2. Asbestos-Containing Paint

Asbestos is another hazardous substance that can increase the risk of home insurance non renewal. If your home contains asbestos-containing paint, it’s essential to have it removed or contained by a licensed professional.

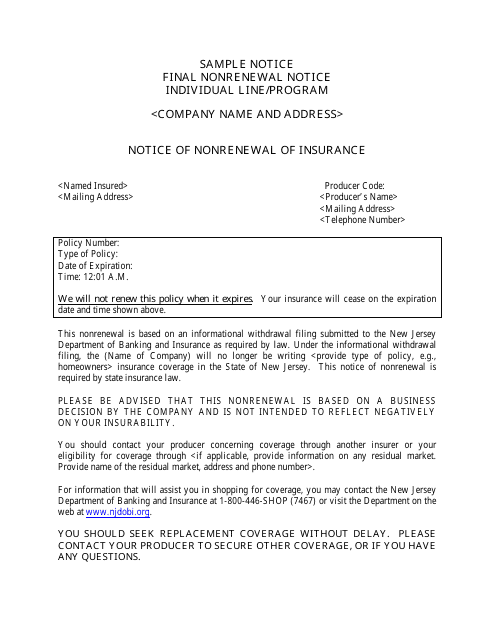

What to Do If You Receive a Home Insurance Non Renewal Notice Because of House Paint

If you receive a home insurance non renewal notice because of house paint, don’t panic! Here are some steps you can take:

1. Read and Understand the Notice

Read the notice carefully and understand the reasons for home insurance non renewal. If you’re unsure about anything, contact your insurance company for clarification.

2. Assess Your Home’s Paint

Take a closer look at your home’s paint and identify any issues that may have led to home insurance non renewal. Make a list of the problems you’ve found.

3. Make Repairs and Improvements

Once you’ve identified the issues, make the necessary repairs and improvements to your home’s paint. This may include repainting your home’s exterior or interior, fixing damaged areas, or removing high-risk materials.

4. Provide Proof to Your Insurance Company

After making the necessary repairs and improvements, provide proof to your insurance company. This may include before-and-after photos, receipts for materials and labor, or a detailed report from a licensed contractor.

The Cost of Home Insurance Non Renewal Because of House Paint

Home insurance non renewal because of house paint can be costly. Here are some expenses you may incur:

1. Higher Premiums

If you’re forced to shop around for a new home insurance policy, you may end up paying higher premiums.

2. Repair and Improvement Costs

Making repairs and improvements to your home’s paint can be expensive. The cost will depend on the extent of the work required.

3. Loss of Discounts

If you’ve lost your current home insurance policy due to home insurance non renewal, you may also lose any discounts you were eligible for.

Conclusion: Home Insurance Non Renewal Because of House Paint

Home insurance non renewal because of house paint is a real possibility. However, by understanding the risks and taking proactive steps to maintain your home’s paint, you can avoid this situation. Remember, your home’s paint is an essential aspect of your home’s overall condition, and insurance companies take it seriously. By taking care of your home’s paint, you can save yourself the hassle and expense of home insurance non renewal.

Takeaway

Home insurance non renewal because of house paint can happen to anyone, but it’s often preventable. By maintaining your home’s paint and addressing any issues promptly, you can reduce the risk of home insurance non renewal and keep your premiums low.